HMRC Furlough Claim Calculator Income Tax Calculator Paycheck Calculator. Click here to visit.

Gst Registration Check How To Check Gstin Validity Indiafilings

The contacts billing address shows on all transactions including paid items invoices credit notes statements quotes and purchase.

. In this field you need to enter invoice number of generated e-Way bill. In case details are available against a particular ticket in SSR and also in portal portal data will take precedence for invoicing. Select a match and the other fields will populate automatically.

Further add other details like the purchase order number PO if any invoice date invoice number and invoice due date. Penalty for incorrect filing of GST return. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

PIAM is the national trade association of all licensed direct and reinsurance companies for general insurance in Malaysia. Currently PIAM has 25 member companies comprising 21 direct general insurance and 4 reinsurance companies operating in Malaysia. Pay the correct GST and get a refund of the wrong type of GST paid earlier.

The registration process takes approximately 3 weeks. No penalty as such. Free GST Free Invoice Generator to help you create invoices in an instant.

In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia. Please check the latest updated rate from the nations official government website. Enter the billing information and make invoices that you can print download as PDF or email to your customer.

Click Enter address manually to enter the details in the blank field. Tax invoices sets out the information requirements for a tax invoice in more detail. Penalty for wrongfully charging GST rate charging.

GSTR 20131 Goods and services tax. Finally you need to enter the captcha and click on GO then your e-Way bill print copy has been generated. The cutoff date.

Passengers flying domestic sectors can Web Check-in at any time up to 48 ho. Persatuan Insurans Am Malaysia. Follow these steps to create and send invoices and deal with unpaid or incorrect invoices.

The GST details required for invoicing like GSTN name of the user address email id and phone number are captured from either SSR or as per registration on portal. You can use the formula TODAY function in invoice date section for ease since it uses the current days date. Create Invoices Generate Estimates Revenue Forecast Finance Payroll.

ITC will be reversed if not paid within 6 months. But interest 18 on shortfall amount. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

The late fees will be calculated for three days and it should be deposited in cash. Avoid long queues at the airport and travel hassle-free with Web Check-in. GST return in GSTR-3B is filed on 23rd January 2021 3 days after the prescribed due date ie 20th January 2021.

X Finance Free Apps. Upon successful GST registration you will receive a Notification of GST Registration letter. Taxable and non-taxable sales.

Penalty for delay in payment of invoice. GST Calculator Australia is a free online tool that helps you to add or subtract the Goods and Services Tax rates to any amount. Here are the details of Late Fees and Interest under GST.

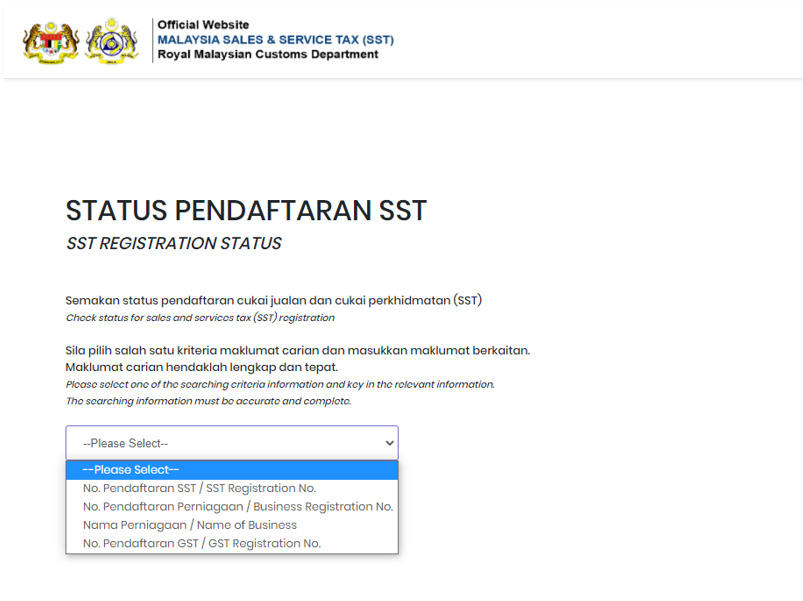

The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes. These rates are taken on January 2020.

EZTaxin GST ready Accounting Software built an easier way to generate the e-way bill without login to government portal ie. Use the Search address field to run a search for the address as you type. Sales and Service Tax SST in Malaysia.

A tax invoice that. How to add or include GST to. This letter will contain your GST number the effective date when your business become GST registered business your filing frequency and filing due dates as well as any other special instructions.

However currently the GST portal. The late fee will depend upon the number of days of delay from the due date.

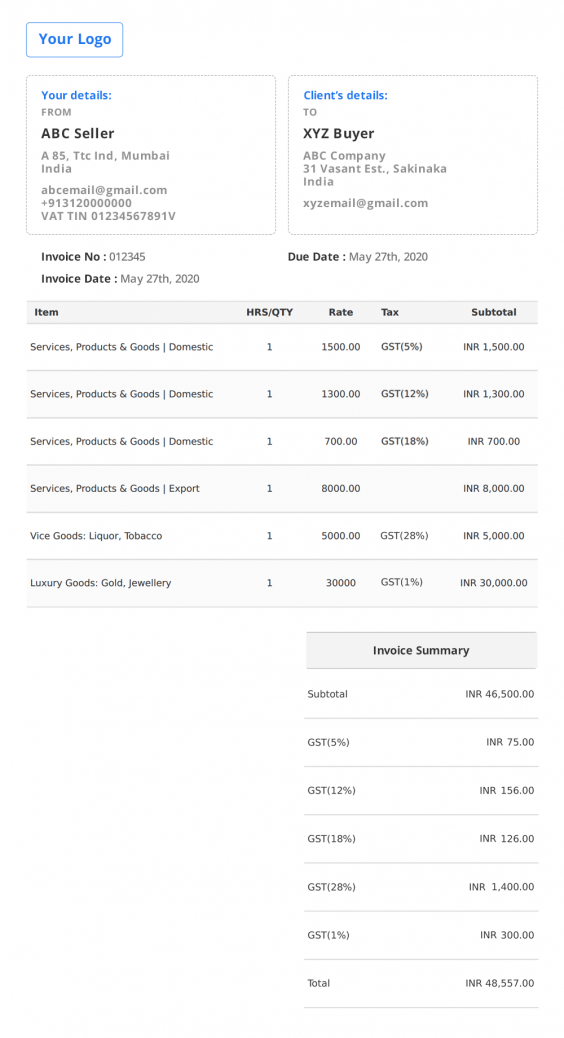

India Invoice Template Free Invoice Generator

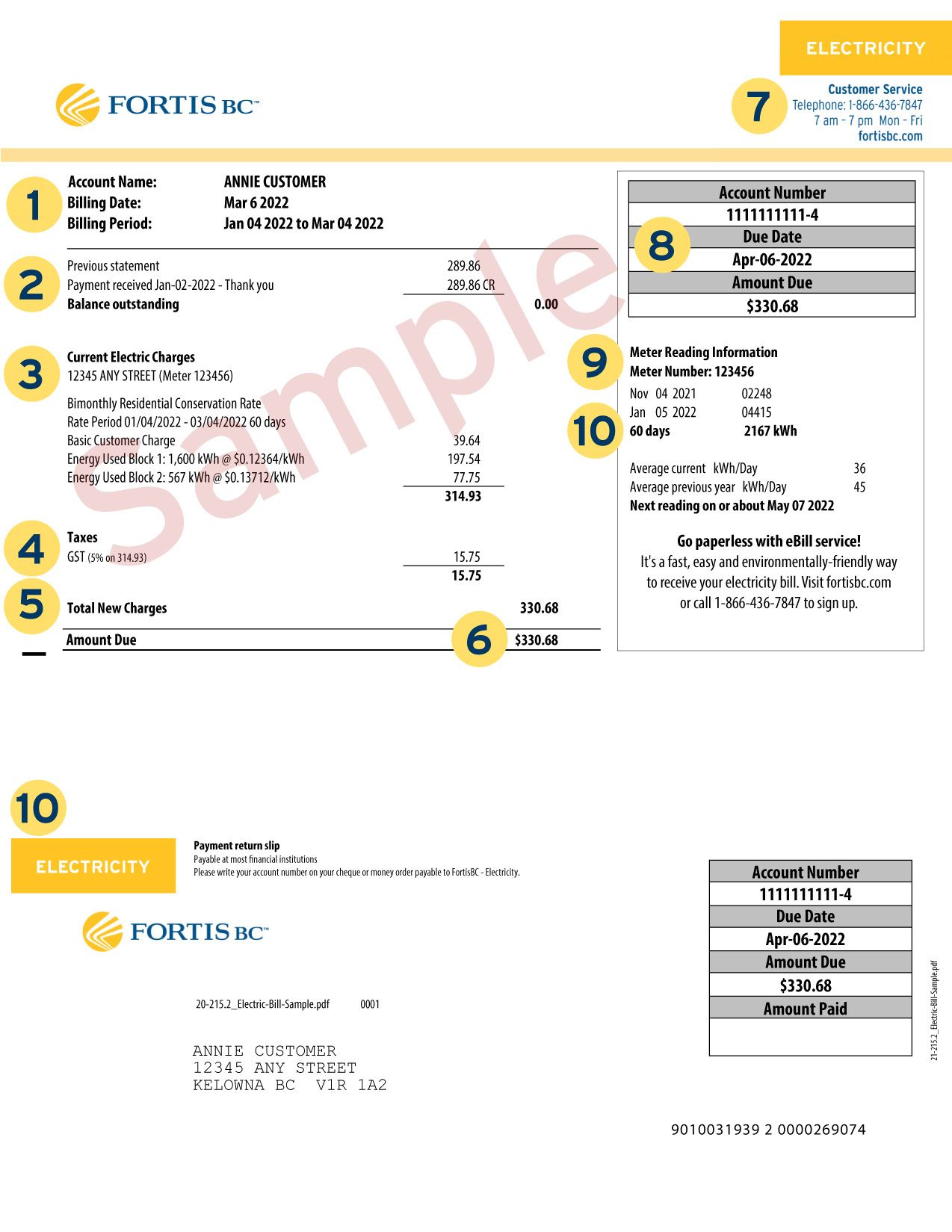

How To Read Your Electricity Bill

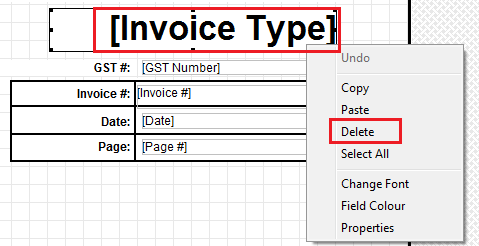

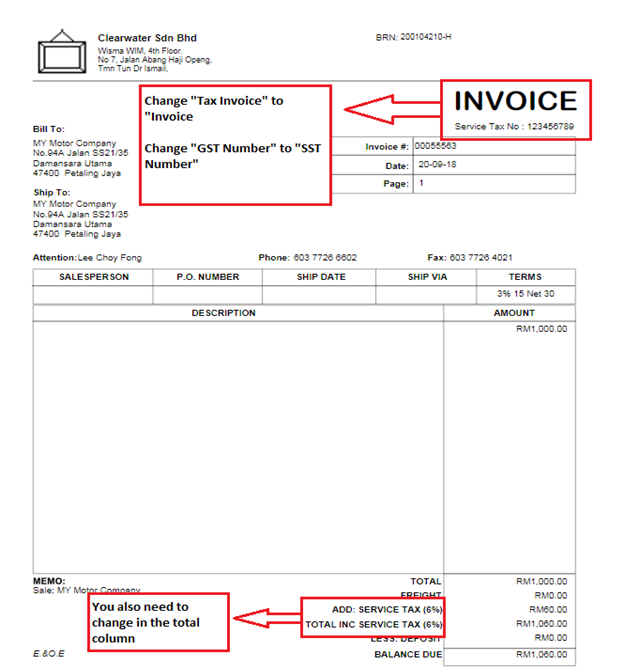

Sst Customized Form Abss Support

Browse Our Example Of Cleaning Services Quotation Template Proposal Templates Business Proposal Template Contract Template

Account And Customer Tax Ids Stripe Documentation

How To Issue Tax Invoice Agoda Partner Hub

Repairing My Macbook Pro Macbook Pro Repair Lettering

Statement Of Account Templates 12 Free Docs Xlsx Pdf Statement Template Personal Financial Statement Bank Statement

Seeing Number Of Gst Notices To Collect Outstanding Gst Directly From Bank Accounts Applies To Ecomm Operators Accounting Tax Services Accounting Software

Malaysia Sst Sales And Service Tax A Complete Guide

How To Issue Tax Invoice Agoda Partner Hub

7 Cara Pos Motosikal Dengan Harga Murah Blog Pakej My Pos Blog Cara

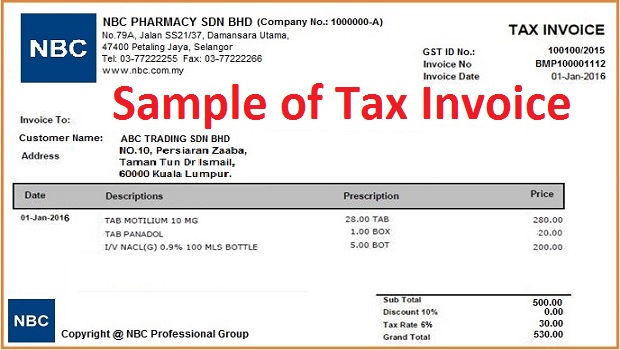

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting So Online Accounting Software Accounting Software Online Accounting

Sst Customized Form Abss Support

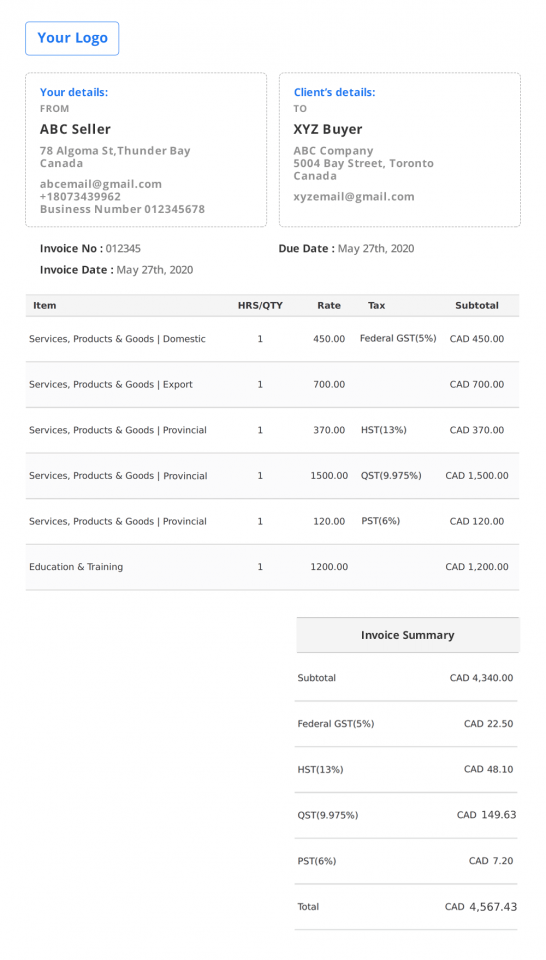

Canada Invoice Template Free Invoice Generator

Malaysia Sst Sales And Service Tax A Complete Guide

Setting Up Taxes In Woocommerce Woocommerce